are full dental implants tax deductible

To help you with this cost the Canada Revenue Agency allows dental expenses to be used as medical expense deductions when you file your income tax. Have a Form Med 2 completed by your dentist.

Dental Implants Cost In Palos Verdes And South Bay California

Insurance must be for procedures that prevent or mitigate dental disease.

/BestDentalInsuranceforImplants-5c56e663e267499a8011f1e26d260841.jpg)

. If your treatment for implant or cosmetic dentistry is 50000 then 45125 is fully tax deductible. If you dont have insurance that covers denture implants and dental implants the entire procedure is eligible as a medical expense on your tax return. Based on your annual income and other medical expenses youve incurred in the year you can receive up to a 25 tax refund on the cost of treatment.

The good news is that will include all of your medical and dental expenses not just your dental implants. The cost was 40000 full set top and. Can I deduct the cost of my all on 4 dental implants Accountants Assistant.

Medical expenses are an itemized deduction on Schedule A and are deductible to the extent they exceed 10 of your adjusted gross income AGI. This brings us back to the question Are porcelain crowns dental implants and fillings medically necessary. Yes if they are not merely cosmetic and the dentist has recommended them as treatment for your dental condition.

By taking this deduction on your tax return you receive a tax refund of roughly 11 281. Dental implants are tax-deductible meaning the IRS might offer significant discounts to seniors on Medicare with extensive physical and oral health expenses. You can only deduct expenses greater than 75 of your income.

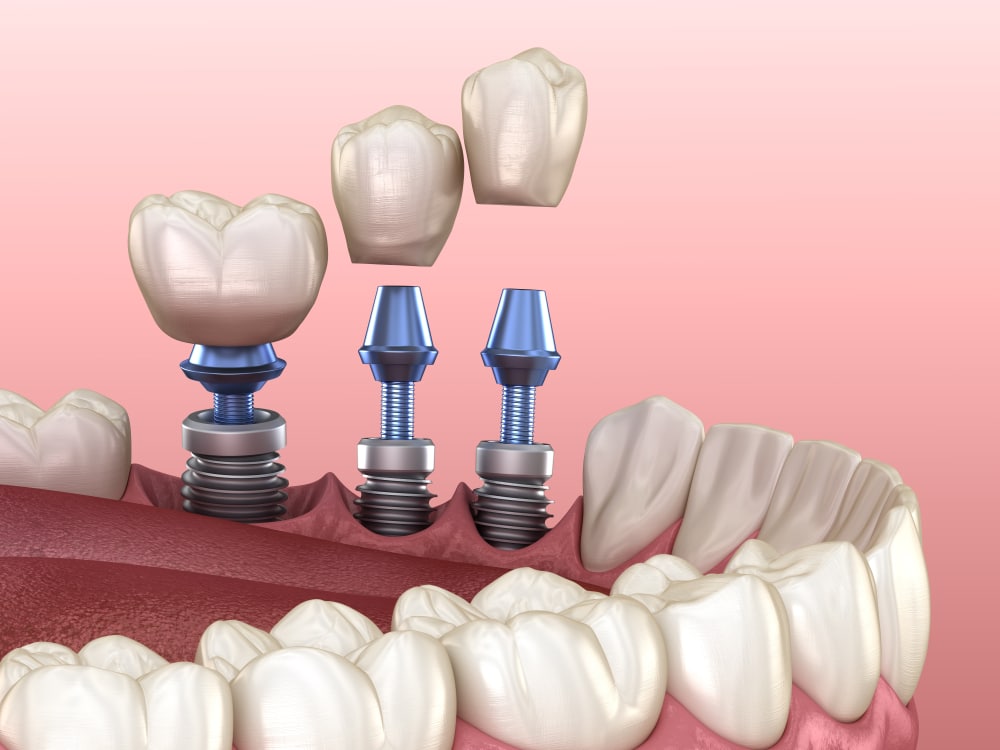

One full arch of teeth four dental implants. Dental insurance premiums may be tax deductible under certain conditions. Paid full fees in late August 2019.

So that means its not possible to deduct the cost of in-home or in-office teeth whitening. Only medically necessary dental treatments are deductible such as teeth cleanings sealants fluoride treatments X-rays fillings braces extractions dentures and dental-related prescription medications. 2019 - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website.

For example if youre a federal employee participating in the premium conversion plan of the Federal Employee. Key points to remember. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them.

Yes dental implants are an approved medical expense that can be deducted on your return. Will get permanent teeth in February 2020. Lets say you make 40K a year.

Dental expenses includes fillings dentures dental implants and other dental work that is not covered by your insurance plan. Are full moth dental implants tax deductible on Schedule A. The Accountant will know how to help.

Your dentist will normally give a Med 2 to you after your treatment. To claim tax relief on non-routine dental expenses you must. You would have to eat the first 3000 of those expenses before it starts lowering your tax obligation.

For this situation any dental treatment beyond 75 of AGI 4875 is fully tax-deductible. Cosmetic procedures like veneers and teeth whitening and non-prescription medicines are not tax-deductible. You can also see any Delta Dental Premier dentist for the same preventive care services and the plan pays 80.

Author has 324 answers and 239K answer views 10 mo. If you are 65 or over they are deductible to the extent they exceed 75 Please click here for more information. So fully deductible if exceed 10 agi in 2019.

Include this amount in your health expenses claim under the Non-Routine heading. Expenses related to OTC toothpaste dental floss mouthwash and general care products are typically not considered tax-deductible either. Doing surgery and temp teeth and implants in September 2019.

Remember though that your itemized deductions for medical dental expenses are reduced by 75 of your Adjusted Gross Income AGI and that total itemized deductions including. The only dental work that is not covered is cosmetic work such as teeth whitening which is not. If you receive treatment over more than one year they must complete a separate Med 2 for.

There is a small catch though. Please tell me more so we can help you best. Is there anything else the Accountant should be aware of.

Dental insurance for purely cosmetic purposes such as teeth whitening or cosmetic implants would not be deductible. Seems IRS pub says you cannot deduct prepayment for services GENERALLY if some services received in future tax year. Employer-sponsored premiums paid under a premium conversion plan cafeteria plan or any other medical and dental expenses paid by the plan arent deductible unless the premiums are included in box 1 of your Form W-2 Wage and Tax Statement.

The Complete Guide To Getting Dental Implants In Thailand

Are Dental Implants Worth It Pros Cons

Are Dental Implants Tax Deductible Drake Wallace Dentistry

5 Best Ways To Get Cheap Dental Implants Updated For 2022

How To Finance Dental Implants The Solutions El Cedro

Dental Implant Cost Near Me Clear Choice Cost Maryland

Dental Implant Cost Near Me Clear Choice Cost Maryland

Implants Dental Insurance Medi Cal Medicare Hsa

12 Easy Ways To Get Affordable Dental Implants In 2022 Authority Dental

/BestDentalInsuranceforImplants-5c56e663e267499a8011f1e26d260841.jpg)

Best Dental Insurance For Implants Of 2022

Dental Implants Navan Meath Navan Dental

Dental Implant Cost Dental Implants Start From 900

Nobelpearl Nobel Biocare Esthetic Dentistry Dental Restoration Dental Implants

Dental Implant Cost Santa Fe Nm Taos Nm Los Alamos Nm Oral Surgery And Dental Implant Center Of Santa Fe

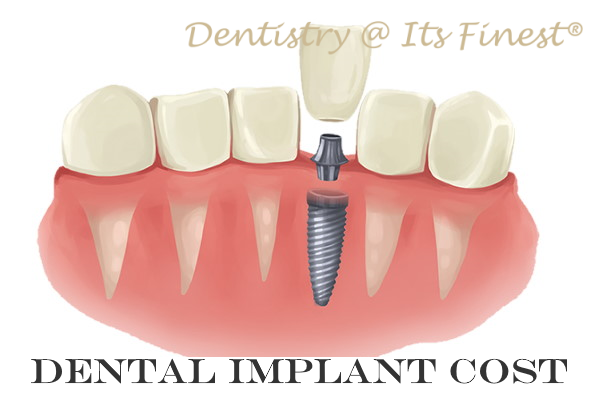

Dental Implant Cost Costa Mesa How Much Does Single Tooth Implant Cost In Orange County Dentistry At Its Finest

Dental Implant Cost Near Me Clear Choice Cost Maryland

Perfit Are Denture Implants And Dental Implants A Cra Tax Credit

3 Open Enrollment Choices To Make Dental Implants Affordable